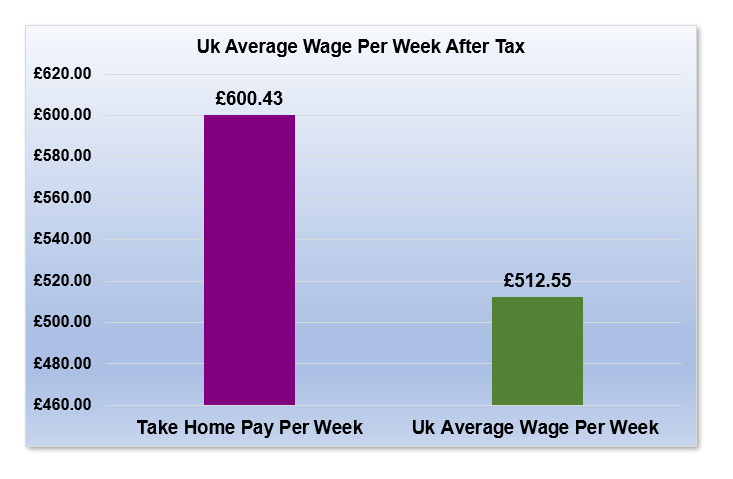

Take Home Pay Calculator

We’re nearing 10% of or gifts being done via automated recurring giving. Qualified Dividends–These are taxed at the same rate as long-term capital gains, lower than that of ordinary dividends. There are many stringent measures in place for dividends to be legally defined as qualified. In 2022, your employer will withhold 6.2% of your wages (up to $147,000) for Social Security. Additionally, you must pay 1.45% of all of your wages for Medicare, without any limitations. If you earn over $200,000, you can expect an extra tax of .9% of your wages, known as the additional Medicare tax.

How to Increase a Take Home Paycheck

Child and Dependent Care–About 20% to 35% of allowable expenses up to $3,000 for each child under 13, a disabled spouse or parent, or another dependent care cost can also be used as a tax credit. Like many other tax credits, this one is also based on income level. Claiming exempt from federal tax withholding on your W4 when you aren’t eligible isn’t illegal but it can have major consequences.

- Embark on a journey to explore your financial horizons as we evaluate your potential daily, weekly, and monthly take-home pay with an annual salary of $42,000.

- Tithe.ly will also support multi-campus setup in popular ChMS platforms like CCB, Breeze, Elvanto, and other church software.

- For the purposes of this calculator, bi-weekly payments occur every other week (though, in some cases, it can be used to mean twice a week).

- Please contact us, the salary calculator is run to support our users and community, your feedback, feature requests and advice ensures greater accuracy and continued support.

Calculate your take-home pay per paycheck for salary and hourly jobs after federal, state & local taxes

Embark on a journey to explore your financial horizons as we evaluate your potential daily, weekly, and monthly take-home pay with an annual salary of $42,000. By understanding the breakdown of your income across different timeframes, you can gain a clearer perspective on your financial landscape. If you are salaried, your annual salary will be your gross income. If you are paid hourly, you must multiple the hours, days and weeks.

How can I reduce my taxes?

Curious about how much you may owe or get back when you file taxes in April 2025? Use this free income tax calculator to project your 2024 federal tax bill or refund. Only after all of these factors are accounted for can a true, finalized take-home-paycheck be calculated. For instance, people often overestimate how much they are able to spend based on an inflated pre-tax income figure. Knowing the after-tax amount of a paycheck and using it to budget can help rectify this issue.

If the idea of a big one-off bill from the IRS scares you, then you can err on the side of caution and adjust your withholding. Each of your paychecks may be smaller, but you’re more likely to get a tax refund and less likely to have tax liability when you fill out your tax return. One way to manage your internal revenue service tax bill is by adjusting your withholdings. The downside to maximizing each paycheck is that you might end up with a bigger tax bill if, come April, you haven’t had enough withheld to cover your tax liability for the year. That would mean that instead of getting a tax refund, you would owe money.

How do you calculate your net pay?

This breakdown sheds light on how your income is allocated over various time periods. We are biased and we think we have the best paycheck calculator 😀 Our calculator is always kept up-to-date with the latest tax rates. It works for salary and hourly jobs, as well as self-employed people. There is also an option to spread your pay out over 12 months. It is important to make the distinction between non-refundable and refundable tax credits.

If the credit brings tax liability down to $0, 40% of the remainder (up to $1,000) can be refunded. To visualize the difference between standard and itemized deductions, take the example of a restaurant with two options for a meal. The first is the a la carte, which is similar to an itemized deduction, and allows the consolidation of a number of items, culminating in a final price. The second option is the standard fixed-price dinner, which is similar to the standard deduction in that most items are already preselected for convenience. Although it isn’t as simple as it is portrayed here, this is a general comparison of itemized and standard deductions. Whether you’re paid monthly or biweekly doesn’t affect the amount of your taxes.

In addition, each spouse’s company may have health insurance coverage for the entire family; it would be wise to compare the offerings of each health insurance plan and choose the preferred plan. Federal income tax is usually the largest tax deduction from gross pay on a paycheck. It is levied by the Internal Service Revenue (IRS) in order to raise revenue for the U.S. federal government.

When you get paid twice a month, you’ll see that you could get a paycheck of anywhere between $ $1365. If you are getting paid monthly then you will have 12 pay periods in a year. That means that to calculate how much 39k a year is per month you will need to divide 39k by 12. If you’re working full-time, 40 hours a week, then your hourly rate will be £18.75. This is a break-down of how your after tax take-home pay is calculated on your £39,000 yearly income. Federal Insurance Contributions Act (FICA) is the payroll tax taken directly from your paycheck.

Federal taxes are progressive (higher rates on higher income levels). At the same time, states have an advanced tax system or a flat tax rate on all income. If you want to know how much income tax you will owe in the United States, our US salary tax calculator can help. Enter your gross income and filing status, and we’ll estimate your income after taxes are deducted. If you live in a state or city with income taxes, those taxes will also affect your take-home pay.