A country’s main lender basically sets the rate for their country or legislation

Because the crypto lending networks always expand, the main topic of interest rates for cryptocurrencies commonly acquire strengths. Now is a very good time to examine the basics.

Just how can Interest rates Really works?

Lenders costs appeal to your money for both individuals and corporations. People borrow funds to invest in large-pass things such as a property, vehicle, or educational costs. Additionally, people have fun with lent fund, or commercial loans, to pay for the a lot of time-name programs and investment. Finance companies also borrow funds, will off some one. Once you put currency within a bank youre effectively financing it to your financial in return for the lending company paying your new supposed interest rate . Ergo, in the event the rates of interest try highest and you are clearly a borrower, after that your financing might be costly; in case you might be a loan provider, otherwise saver, up coming you would obtain more make the most of the better costs.

What Determines Interest rates?

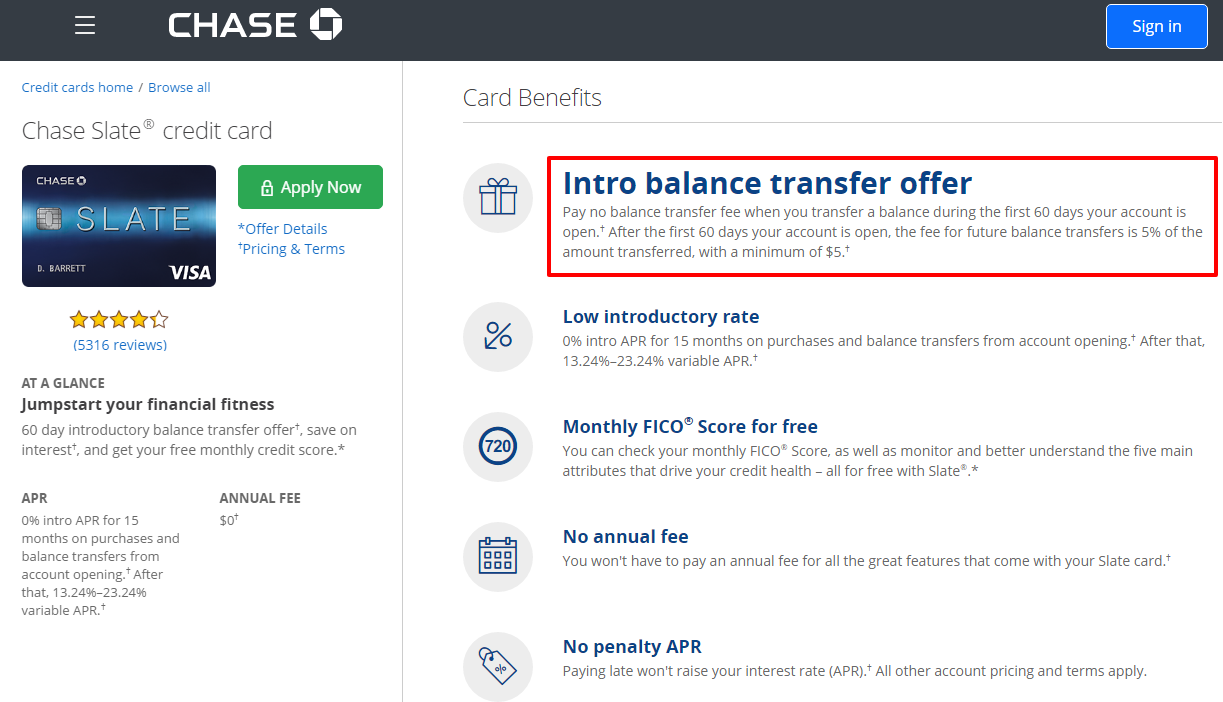

In america, the Federal Set-aside (this new Given) sets interest rates according to research by the government financing rates or right away rates, which is the rate you to definitely industrial financial institutions charges both to lend otherwise borrow funds about at once markets. Banks make use of the latest rate of interest to see which annual payment prices (APR) to give. An annual percentage rate is nearly constantly greater than mortgage loan given that it stands for the accumulation out-of an entire year of interest cost along with other costs such as for instance representative fees or closing costs. And if you’re researching mortgages, new Annual percentage rate ‘s the a lot more perfect speed to consider.

The newest government finance rates also forms the foundation into the best price , and this finance companies explore to possess small-label items like varying-price mortgages, auto loans, credit cards, and house security finance. The top speed try expressed given that Finest + a percentage, and installment loans in Houston is fundamentally from the 3% greater than this new federal financing rate.

A lender will usually promote some one finance with different rates dependent on an applicant’s private level of chance. If the a bank believes there is certainly a spin that a customers you are going to maybe not pay back the loans, this may be might not give all of them financing whatsoever, otherwise provide all of them a top interest rate. When the a buyers possess a low credit score, then financial will likely give that individual a top rate of interest than it might for an individual which have the common credit get. A bank tend to normally render its prominent customers, individuals with pristine borrowing records while the higher credit scores, the top rates.

Repaired Rather than Adjustable Interest levels

Financial institutions fees either fixed otherwise variable rates. Fixed-prices stay an equivalent to the life of a loan; and you can initially, your instalments will is mostly from paying off the interest. However, over the years and also you pay down the debt, you are able to owe increasingly high servings of prominent loan amount . Variable-prices changes on perfect speed and can even connect with people sort of personal debt device that does not have a predetermined-rate of interest.

A home loan may come in the form of a fixed- otherwise varying-speed financing. When you look at the the lowest-interest-speed markets, an adjustable-rate mortgage you certainly will benefit the fresh new debtor as the the money you will definitely fall off as costs fall off, however in a top-interest-speed environment, good borrower’s costs are inclined to improve and cost them a great deal more over the years. Each type from rates comes with positives and negatives. Before borrowing from the bank or financing money of any type, you should look into the kinds of fund offered also their attention costs.

Highest Rather than Low interest rates

High interest levels create money more costly. When rates is actually high, anyone and you will companies could possibly get struggle to acquire. This leads to quicker available borrowing from the bank to pay for commands, which in turn can result in consumer consult so you’re able to stagnate. Low interest rates, as well, carry out interest in big requests eg a property, which usually require loans. Low interest as well as build business loans less expensive, and this prompts brand new people to discharge and you can brings in it the newest likelihood of brand new work. In the event that low interest rates provide this type of advantages, up coming why would not cost be kept lower throughout the day? Though governing bodies create keep interest rates reasonable, they need to be cautious given that a keen insidious complication out-of low interest rates was rising prices. That have rising prices, the expenses of goods and you can features go up plus the money has actually quicker to buy strength, which can make something more challenging just in case you currently struggle purchasing essentials.

Earning Desire for the Crypto Lending Networks

Compared to the borrowing and you can credit contained in this conventional markets for example home, borrowing from the bank and you will lending inside the cryptocurrency market is however in early days. However, the growth regarding crypto financing platforms therefore the increased dependence on rates of interest to possess crypto you will deeply change the room. Borrowing from the bank and you will lending money could potentially make field pastime to own cryptocurrencies during the a few means. First, the thought of rates is actually common to participants in the traditional monetary places. Therefore particular buyers – whom possibly wasn’t always crypto in past times – you’ll become interested in cryptocurrencies more it adopt interest levels. 2nd, for these buyers just who currently keep cryptocurrencies, the prospect out-of collecting notice can offer them a reward in order to give it, also – hence leading to new move off assets for the crypto markets.

Cryptopedia does not guarantee the precision of your own Content and you will should not be stored accountable for any mistakes, omissions, or discrepancies. The brand new opinions and you will feedback indicated in virtually any Cryptopedia article is actually exclusively the ones from the writer(s) and don’t echo the brand new views from Gemini otherwise its management. The information considering on the site is actually for informational purposes simply, therefore cannot compensate an affirmation of any of the products chatted about otherwise money, monetary, otherwise trade guidance. A professional professional will likely be consulted before making financial conclusion. Please go to all of our Cryptopedia Webpages Policy for more information.