Advantages compared to Dangers of Owner Funding and you will Book To possess

In addition, it assists in maintaining track of repayments which can help your own financial afterwards

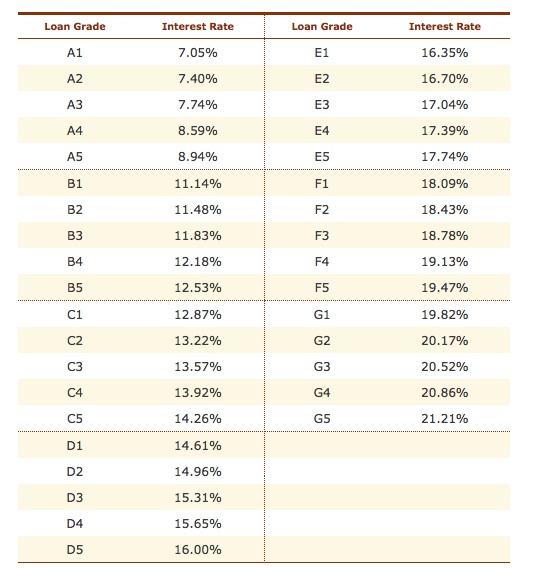

- Monthly PaymentMonthly Percentage towards the an owner offer is like compared to Conventional, FHA, otherwise Va investment in this, considering mortgage that individuals make it easier to negotiate, you pay Principle, Appeal, Fees, Insurance, and frequently HOA if the appropriate. There could be flooding insurance rates, exactly what you will never have is Morgage Insurance coverage. Are you aware that Rate of interest, so it once more try flexible. This will depend on current market rates of interest, just what vendor already will pay, what the seller owes, and other situations. By 2023, which have prices higher than these people were into the 2022, with of a lot manufacturers refinancing on all the way down step three% or cuatro%, you could potentially usually negotiate less interest rate. Although not, for every merchant is different and in my personal go out I’ve seen loans in Emelle due to the fact reduced just like the 4% or of up to ten%. Usually, we see between 5% and you can eight% notice and is fully amortized, you you’ll discuss attract merely as well.

- Agreements InvolvedWe make use of the Oregon-recognized Buy and you may Transformation Contract which provides the best protections together having a supplier Resource Addendum that truly distills what you also interest rate, balloon or label of the deal, advance payment, how fees and you can insurance try paid back, alternative party contract maintenance alternative, and more. Which have assisted more than 100 customers and vendors with holder investment deals, I am able to discuss it entirely to you and refer one to one of our common attorney to answer people judge questions we are incapable of respond to.

Yet another risk ‘s the supplier collecting the bucks rather than using the borrowed funds

Proprietor Money is an excellent cure for pick and also in specific times, better than providing a normal financial. Smaller Settlement costs and you will potentially a lower interest than sector pricing which have probably lower down commission than 20% off. You can find a limited number of property owners giving proprietor capital, so there will always be threats which have a preliminary-label balloon owed in a single in order to five years, however commonly a renter and have now an equivalent experts of purchasing property with home financing. You need to be proactive and make certain you could potentially meet with the terms prior to purchasing. Contact us for a free of charge appointment about what is the best for your.

To invest in a property having Manager Capital or Lease Choice (Lease To own) can be quite best for you pending your circumstances. This has safety for those who have a strategy and you may discover they can carry out the plan and get recognized for home financing when you look at the name offered to. But not, People who are able to negotiate an owner bargain get possession benefits which help more financially as opposed to still are a renter. An owner offer in addition to enables you to refinance based on the appraised value against the cost, while a rental Choice merely enables you to foot the borrowed funds to really worth towards purchase price, even if the worth is actually higher. A manager package is commonly lengthened and if you are incapable to help you re-finance for any reason within the name, you can promote the house to truly get your money back, whereas probably you is not able to do that having a lease Alternative otherwise Lease to own, so your initially downpayment is far more safe. As well as, that have an owner price, you may be in a position to build sweating guarantee provided the fresh new deal does not indicate or even. Part of the exposure for types of to invest in has anything titled a create Discounted Clause whether your supplier possess a mortgage nonetheless on the property. However, we will discuss so it alot more with you and how i let all of our people and you will vendors navigate from this risk, and you may what we should do to help our readers after they been round the that it condition. That is why i constantly negotiate to utilize a third-people offer maintenance business to gather the new commission away from you and you will spend one lien proprietors first. Everything else is done particularly a consistent buy along with getting name insurance coverage and recording their contract into state so that you do not remove your vested attract. If you have any queries otherwise questions, submit the form below.