Into Good Rs 50k Salary, What’s the Maximum Count An individual can Borrow For An effective Unsecured loan?

Are you trying determine the absolute most you can use together with your newest income? If yes, you will be better off understanding that the total amount hinges on multiple issues. Your revenue is not necessarily the just deciding basis. More over, the financial possess an alternate algorithm and you will laws so you can assess the new maximum lending matter for certain income. For this reason, the amount you could obtain differ out of lender so you’re able to bank.

Read on this blog to learn more about figuring your restriction borrowing from the bank strength. The blog will additionally answer questions connected with a consumer loan on the an excellent 50,000 paycheck .

Maximum Unsecured loan To possess 50,000 Paycheck

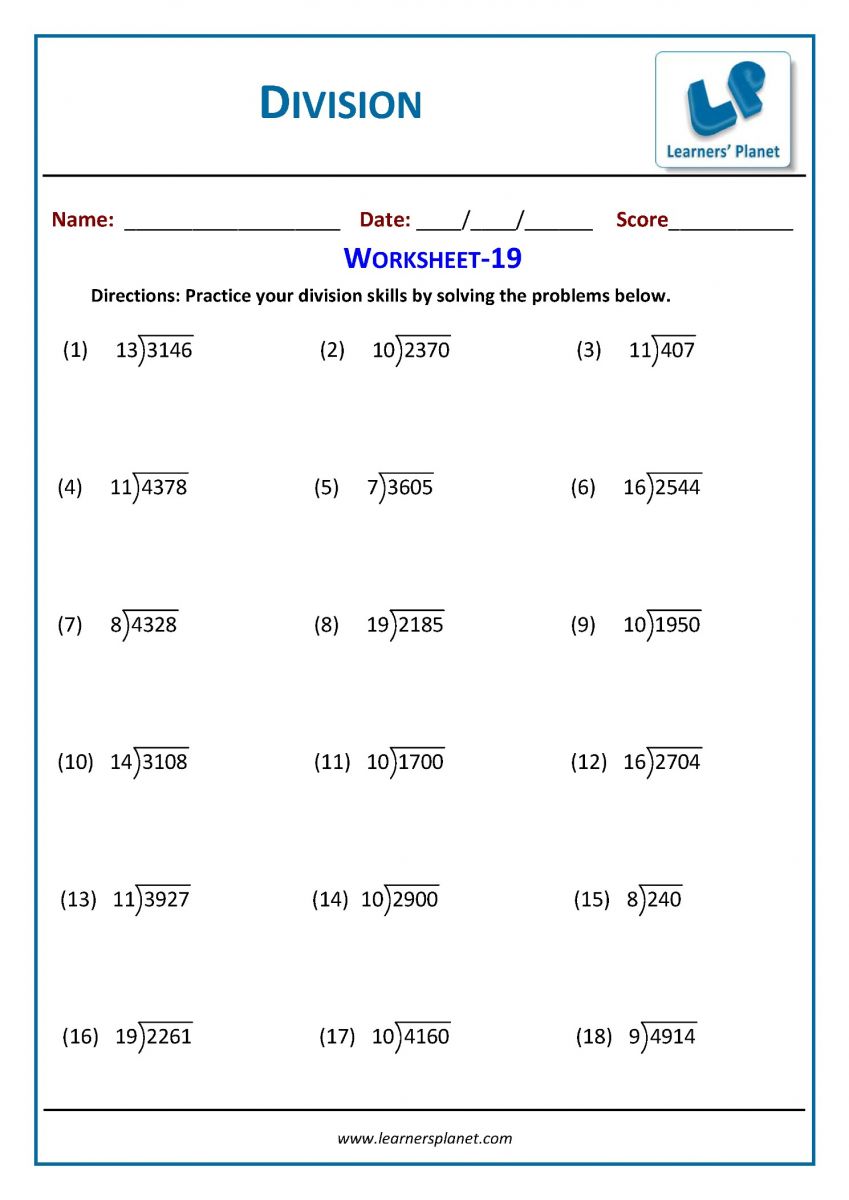

Most lenders utilize the multiplier approach to calculate the maximum individual financing to possess a great 50,000 income . It involves handling a fixed numerous with the salary count.

Depending on the lender, the fresh numerous will be anywhere between 10 and 24. The newest dining table lower than will provide you with a reasonable thought of brand new limitation personal loan for a good 50,000 income.

Tips Assess Your own Maximum Borrowing from the bank Capabilities

Elements on what the maximum consumer loan for a fifty,000 salary utilizes were simply how much you will be making, your credit score, plus the form of loan you’re trying to get.

- Income

Your revenue establishes your investing ability. A lender is ready to financing you a price one you might conveniently pay together with your money during the time from application.

- A position Updates

Your a job condition influences the credit capability. Lenders much more comfy cleaning apps from those with a typical money. Their credit strength might be notably down without having that. Sometimes, loan providers could possibly get refuse applications of men and women without a consistent money. This happens in the event that exposure is viewed as to get too high.

- Credit history

When you have good borrowing records, illustrated from the a credit history significantly more than 800, you will be able in order to acquire a great deal more.

- Age

While you are drawing near to retirement age or your own typical money will avoid or fall off, their credit skill often disappear significantly.

Should you want to assess what kind of cash you can get just like the a personal bank loan towards a good 50,000 paycheck , the simplest way is to use a finance calculator. It is an internet equipment used to determine just how much you could potentially acquire centered on your income, assets, or any other things.

Methods for a silky Unsecured loan App

For those who currently have a lender willing to provide your money, you can submit an application for a consumer loan on a great 50,000 salary . There are many things to note ahead of time applying having finance.

- Be sure to has actually a keen itemised directory of all your loans and expenditures. Their financial get ask for it within the software process. These details are needed to workout their investing strength. They takes on an important role when you look at the determining the amount of money brand new financial is provide you without causing a substantial chance of default. With this info collected makes the application techniques smoother. Be sure to has an in depth intend on how you will pay off people remaining financial obligation. It is among the many concerns your loan agent can get ask you within the application process.

- Aside from this type of, you need a set of data. They’re:

- A government-provided photo label card. You should use your Aadhaar Card, driving licence otherwise Voter ID for this purpose.

- Then there are to supply proof your earnings. Salary slides are ideal for which goal. not, specific loan providers may require a duplicate of your own passbook.

- On top of that, you’ll have to establish address evidence and you will, in some cases, a great terminated cheque. It is to show you have an active family savings.

Interest levels on a consumer loan

One way to examine a personal bank loan so you can a good 50,000 income will be to go through the interest rate. When looking at interest rates, you ought to look at the installment duration of the borrowed funds.

Short-label financing might have a top interest, if you’re long-identity finance might have a reduced interest. Unsecured loans are available at large rates of interest versus other sorts of finance, particularly home and you may education fund. They likewise have a fairly less cost several months.

Rates of interest for personal finance into the a great fifty,000 salary are normally taken for bank so you’re able to bank. Thus, checking with many lenders regarding their loan even offers is vital before you start the job. In that way, you will find the finest deal yourself.

Lenders often encourage down interest levels to possess funds during festive season. You could make the most of such opportunities when you’re trying to that loan.

Payment Agenda to own a personal bank loan

Once you borrow money away from a lender, you have to make monthly installments before mortgage try reduced. The borrowed funds words supplied by really loan providers includes brand new cost plan. The fresh payment agenda for a personal loan will include new monthly percentage matter, if the money begin and moratorium months, in the event the appropriate.

Along the new fees schedule will even rely on this new type of financing you are taking. Extremely large financing will have an expression ranging from ten so you can three decades. When it comes to a personal loan, the newest fees agenda is a lot faster. The genuine go out, as mentioned, varies according to what kind of cash you’re borrowing. However you will possess some state into the fixing the loan fees schedule. But not, you’ll have to make advice into the wide variables the lender enjoys set.

Conclusion

With additional digitisation during the financial, possible submit an application for personal loans to the a 50,000 paycheck on the internet. All of the lenders provide the accessibility to on the internet applications. Leading loan providers have a loan and EMI calculator. You should use these to dictate the borrowed funds you will get to suit your web paycheck. Aside from the apparent experts, this helps you see whether or not you can spend from the mortgage regarding specified day.

To find out the best way to benefit by using EMI calculators, are the one created by Piramal Money . You can read its posts for a further comprehension of how such calculators really payday loans Fultondale works.