Will it Make sense to utilize a consumer loan to have a great Cellular Household?

The word, otherwise period of time you have got to repay an unsecured loan, is normally regarding the one or two to help you five years. This will be far reduced versus payment identity for a mortgage, which can be numerous years a lot of time. Thus you’ll have a shorter time to repay your own unsecured loan, which can make your monthly installments high.

Rates of interest

Unsecured signature loans have higher interest rates than secured loans because there is no collateral towards the bank to grab when the your default on mortgage. Given that financial is taking up more exposure by the financing in order to your having an unsecured consumer loan, they’re going to basically charges significantly more for the attract.

Additionally, you will have likely to meet up with a minimum income and you will borrowing score to be accepted to possess a consumer loan. Certain loan providers carry out render a personal loan to have low income , but this type of loan have a high interest rate.

Personal loans can be used for whatever objective, and resource a cellular family otherwise because the finance to possess house update . Which independency means to purchase a mobile home with a personal financing makes experience to you. But not, in the event your are produced domestic qualifies given that property – definition it is towards the a foundation, has no tires, while very own this new property below they – you will be best off with other funding solutions.

When your mobile family match the expression real property, you could potentially apply for a mortgage with a few old-fashioned mortgage apps, including Federal national mortgage association otherwise Freddie Mac, or agency-recognized financial software, such as those in the Federal Houses Administration (FHA), the brand new You.S. Institution from Pros Facts, or perhaps the U.S. Institution from Agriculture.

An alternative investment alternative you could potentially explore for a mobile residence is a good chattel mortgage. This is exactly a variety of personal property financing which is often used for movable property, such as for example if the mobile home is based in a produced household area and you lease the house the brand new cellular is on. The borrowed funds does not include the homes, therefore the closure processes is a lot easier and less costly than just it is by using a traditional home mortgage. But not, chattel financing are usually for small amounts of money than mortgages try, and they have shorter repayment terminology. This means the attention costs to your chattel financing are usually large, which will lead to highest month-to-month mortgage money.

Providing a personal bank loan to own a mobile Household

If you have felt like a personal loan ‘s the proper selection Red Bay loans for your own cellular household buy, there are a few stages in the method. This is what doing.

1pare Loan providers

When looking for a personal loan to have a cellular house, you will want to contrast lenders observe exactly what pricing and you may terminology they you’ll provide. You can explore choices regarding banking companies and you can credit unions, together with men and women of on line lenders. When choosing an internet bank, beware of people warning flag one rule the lending company may not become reputable. Look out for things like impractical promises, inaccuracies on loan fine print, and you can wants upfront software costs.

2. Apply On line

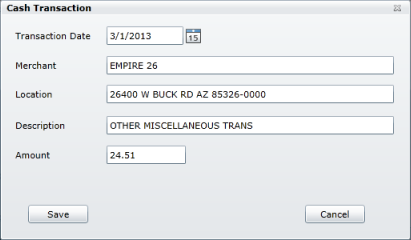

When you get a hold of a loan provider, you could sign up for a personal loan . Using on the net is the quickest and easiest method. As you become become, be aware that there are certain consumer loan conditions you’ll need to satisfy. As an instance, you will need to sign up and provide a number of data files, like proof money, work, and name. Collect these types of files ahead of time and have now all of them ready.

step three. Discover Funds

Shortly after you’re acknowledged for a personal bank loan, you’ll receive the amount of money during the a lump sum, usually inside several days. Certain lenders even offer exact same-big date resource. You may then repay the bucks you owe with notice over time for the monthly premiums.